The Brief

In 2016, Oracle published The Millennial Migration, giving banks understanding on their relevance in a digital driven millennial mind. This report was a follow up to the Benchmarking Tool which was also created to allow industry professionals to place themselves against their peers.

In 2017, Oracle wanted to shift the angle of their thought leadership to helping banks stay relevant in a digitally-driven and customer-centric world.

Key Objectives

Maintain Oracle’s position as a thought leader in the Consumer-facing Financial Services space that understands its customers best and provides solutions that enable better results

Provide banks with the impetus to embrace change and actionable plans to facilitate the shift from being product-centric to customer-centric

Secondarily, to generate leads through this original research piece

The Challenge

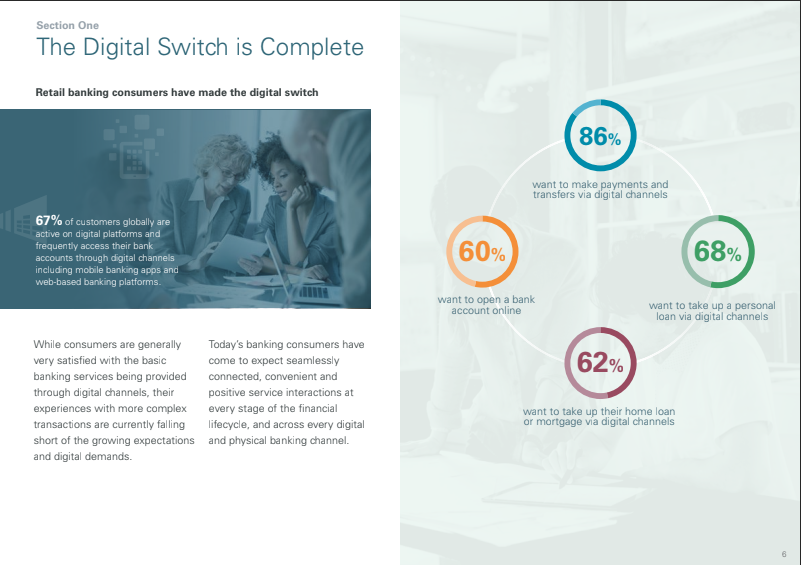

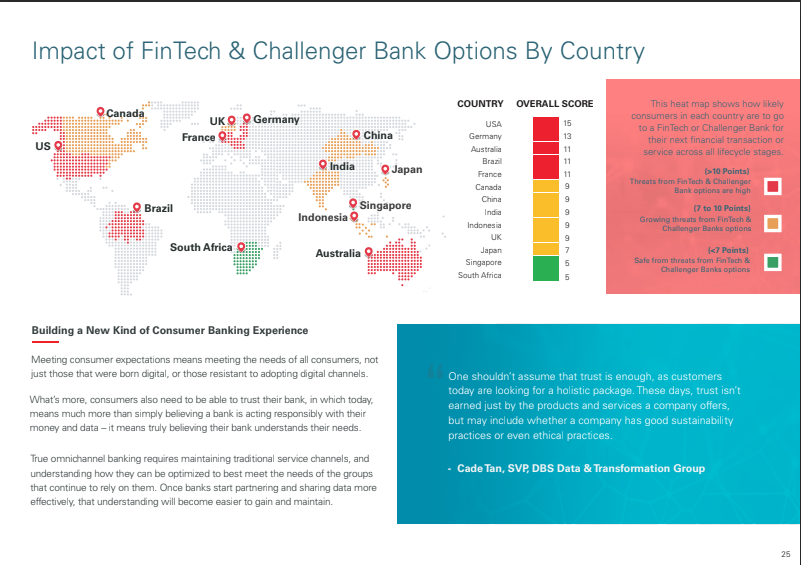

Banks are seen as large, clunky organisations that have fallen behind the speed at which technology is evolving. FinTechs have crept in to fill the gap, stealing market share from financial instituitions and creating new consumer expectations along the way. Banks found themselves needed to innovation, to not become a casualty of creative destruction.

Solution

We mapped out the life moments and key stages of several banking consumer personas, and the Next Best Action they would take in their banking customer lifecycle journey. We termed these key interaction points as #betterbanking opportunity moments. A research study was commissioned to validate our hypotheses.

We also spoke with thought leaders in academia and FinTech to enrich the report findings.

The final report was used as a demand generation tool, with bite-sized assets created to be used for communications outreach and part of the sales toolkit.